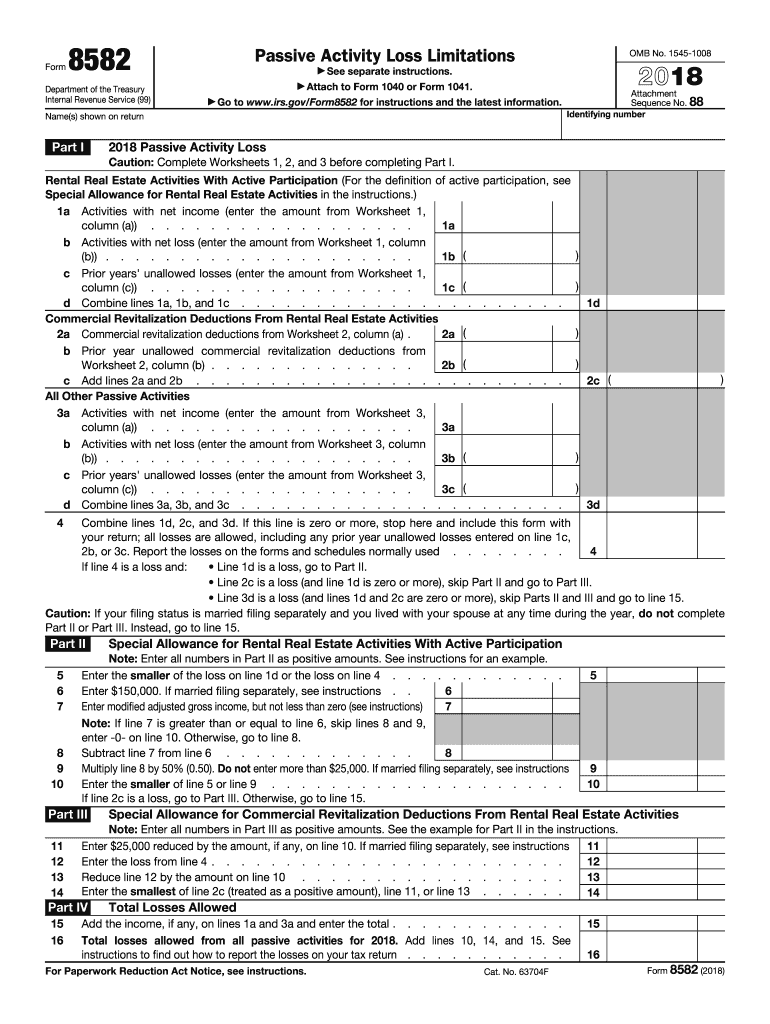

Who Needs Form 8582?

The United States Internal Revenue Service demands all noncorporate taxpayers to figure out the amount of any passive activity loss for the current tax year and to report the previously made request for exceedable of allowed loss in passive activity. The most typical passive activity is property rental or an activity in which the taxpayer does take an active part. A passive activity loss is a situation when the sum of all losses (including those from previous years) from passive activities is higher than the total income of all the taxpayer’s passive activities.

What is Form 8582 for?

The form is fully called Passive Activity Loss Limitations. It aims to let the IRS establish the taxpayer’s eligibility for allowances in tax payments.

Is Form 8582 Accompanied by any Other Documents?

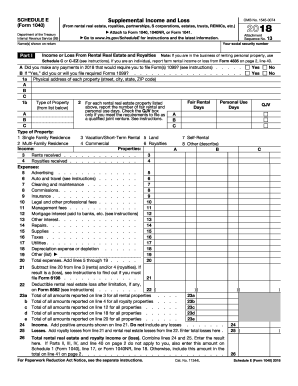

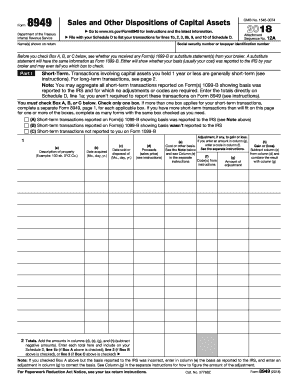

As it is indicated at the very top of the document, Form 8582 must be filed together with the individual tax return, i.e. Form 1040 or 1041. No other documents are supposed to accompany Form 8582, yet all the applicable attachments to forms 1040 or 1041 must be submitted as a single package too.

When is Form 8582 Due?

Because the given form is an attachment to the tax return, it does not have an individual deadline for submission. The due date of Form 8582 is the same as of the tax return.

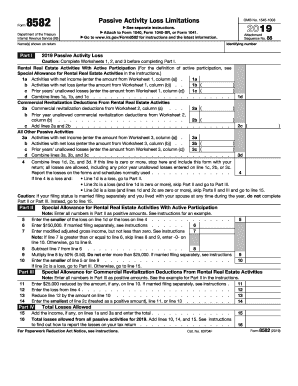

How do I Fill out Form 8582?

The form is a three-page document. The IRS provides detailed instructions on how to fill out the form properly on this website, it should be referred to in case you face any difficulties with understanding what kind of information is being asked for.

The document is divided into seven worksheets, but not all are necessarily to fill out as it depends upon the individual’s circumstances.

Where to File Form 8582?

Together with the tax return, the form must be directed to the local IRS office by the deadline.